One of the hardest things to tackle when it comes to managing your money is trying to figure out how to make ends meet if your broke. Creating a budget is even harder when you are behind on bills and don’t know where to start. The basic budgeting steps are the same, but your spending and breakdown of expenses might look a little different. If you are behind on bills, you are going to spend a little more time assessing your situation and coming to terms with how bad things really are.

If you are in this situation and are trying to come up with a money plan, here is what you need to do set up a working budget and get back on track.

If you have put off looking at your real situation because you are afraid to see how bad it really is, I urge you to push past that fear. You will never be able to dig yourself out if you don’t know how deep the hole is. Remember, you can’t change past decisions that put you in this situation, but you can change them now and in the future. The most important thing to focus on is moving forward and not backward.

You need to now how much money you have coming in versus how much money you have going out. If you are reading this, you probably have more money leaving than you do coming in and that’s OK. Here are the things you need to do to assess your current financial situation.

CATEGORIZE YOUR EXPENSES

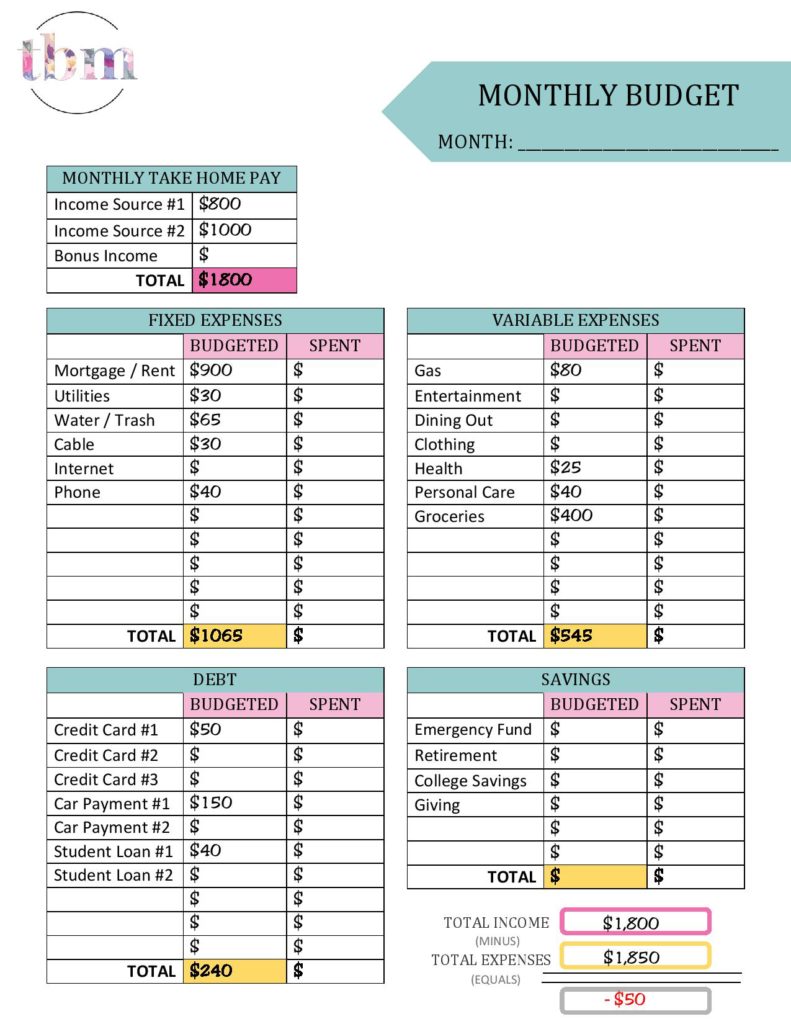

The first thing you need to do is take out a blank piece of paper and write down your monthly income. This is the money that you actually see in your checking account when you get paid.

Next, you need to write down ALL of your expenses. EVERY single thing you spend money on every month needs to be recorded. Some of your expenses might include cable, utilities, food, gas, clothes, etc. Make sure to list all of your bill and debt payments on this list as well. The best way to do this is by looking at your bank statements for the last 2 months. This will give you a good idea of where your money is actually going.

Once you have everything listed out, it’s time to organize everything. The main thing we are going to organize is your expenses. I want you to organize all of your expenses into these 3 categories:

- DEBT

- REGULAR MONTHLY BILLS (FIXED EXPENSES)

- VARIABLE EXPENSES

DEBT: This category is to record all debts that you need to pay off. Make sure to list every debt you have, even if you are not currently making payments.

REGULAR MONTHLY BILLS/FIXED EXPENSES: In this category, you need to list the bills you have to pay every month. For example, your expenses might include things like mortgage, utilities, cable, and cell phone bills. These bills are usually the same amount every month and need to be paid around the same time every month.

VARIABLE EXPENSES: This is just a fancy word for expenses that change in value from month-to-month. For example, gas is a variable expense. Your gas doesn’t have a due date and you might spend $100 this month on gas but only $50 next month. Do you see how one month might be a small amount and the next month might be a higher amount? Some other examples of variable expenses are food, clothes, house supplies, beauty and personal health expenses, child expenses, and entertainment.

To help you organize your expenses, I want you to download my free budget worksheet. This will help with the organization process and will help you set up a simple monthly budget.

When you have all income and expenses listed, add up all of your monthly expenses and subtract that amount from your monthly income. If you are behind on bills, don’t worry about saving money for the time being. This is something that you should eventually add to your budget but right now you need to focus on getting caught up.

IDENTIFY WHICH BILLS YOU ARE BEHIND ON

From your debt and regular monthly bill categories, I want you to highlight the bills that you are currently behind on. These just became your first priority. If you are starting a budget when you are behind on bills, it’s important that you don’t fall even further behind. You do that by addressing the most urgent bills first and that’s where identifying past due bills comes in.

Once you have your past due bills highlighted, next to each one, I want you to list how much you are behind. For example, if you have a mortgage and you are two months behind and your monthly mortgage payment is $500, then you are behind $1000 (2 x #500). So you would write $1000 next to your mortgage bill on your expense list.

Do this for every past due bill. By doing this, you get a clear picture of your current financial situation. By creating your budget from my free budget worksheet, you are able to see if you are in the green or red (more money coming than going out). By listing all of your past due bills and the amount you are behind, you get a clear picture of your financial situation.

Use the following Past Due Checklist to help organize the things you have fallen behind on. You can also use it to record notes from your phone calls with the creditors and to write down your new repayment plan to get caught back up.

You might be behind on bills but you also might have options. Most of the time, creditors are willing to work with you if you are willing to make an effort to get caught up. Use the above Past Due worksheet and call every creditor for the bills you are behind on. Simply explain your situation and ask if there are any available options for you. They might allow you to make monthly payments to get caught back up. What this might mean is they will add that extra payment to your regular monthly bill until it’s completely caught up. It might also mean that they will allow you to make a certain number of fixed payments until the amount you owe is paid off. They also might have programs that can assist you.

You will never know your options until you call them. I know this might be scary or embarrassing, but trust me, you are not the only one in this situation. Here are some tips you can use when trying to negotiate your past due bills:

- Be kind, not matter how frustrated you might be: If you have a goal in mind of what you want, it’s easier to get it if the person on the other side of the phone likes you. That means speaking in a calm voice, being courteous and respectful, and speaking with confidence. This will help you when you feel like reaching through the phone and punching them in the face.

- Always ask for more than what you want: For example, if your goal is to set up monthly payments of $100 to get caught up on your mortgage, start by asking for $75. When you are negotiating with someone, you both want the same solution – to pay off your past due amount. That means, you both have to be willing to give in a little. If you start by asking for more than what you want (or smaller monthly payments), you have wiggle room to negotiate. If the creditor feels you are willing to work with them, they might feel more comfortable doing it as well.

- Keep in mind that the person you first get on the phone isn’t really in a position to negotiate. They are usually just the first customer service agent in a huge line of representatives. My point is, if they say they can’t help, don’t take no for an answer. There IS someone there who is authorized to negotiate with you but they just might be a few desks away. If you get a representative who is really not helpful try hanging up and calling them back. Usually, you will get another representative who will be more willing to help. If that doesn’t work, you can always go to the last resort. Ask to cancel your service. You might not actually want to cancel your service, but you are more likely to reach someone who can help you pay off your past due amount.

You will now be able to see your spending habits by looking at the budget you created in Step #1. Most likely, there are some categories that you can cut back on. Do you spend too much at the grocery store on unnecessary food items? Do you have a coffee habit that is eating away a lot of your funds? It’s important to recognize where your weakness are when it comes to spending and keep those in your mind as you are working on your new budget. The truth is, if you are behind on your bills, you might have to cut out the small spending pleasures until you get caught back up.

You will need extra funds to address past due bill payments. Remember, you still have to get caught back up and that means you will probably be paying more than your minimum payment for a while. To address this, you can do two different things. Cut your expenses or make extra income.

In order for you to cut back on your spending, you need to address the problem areas you identified in Step #3. You also need to look at your Variable Expenses from your budget and look for ways to cut down costs. This means looking for things that are more of a luxury than a need. Trying to manage your money when you don’t have a lot of it means you really have to think about downsizing your lifestyle for a while. Here are some examples of unnecessary expenses that you might be able to reduce:

- Cable

- Cell Phone Plan

- Entertainment Costs

- Gas

- Eating out

Look for ways you can downsize and reduce these expenses. Instead of paying for an expensive cable plan, look into Netflix or Hulu which can start as low as $5.99 per month or cut it out all together.

Ditch your outrageous cell phone plan and look into joint plans with your spouse. Get rid of the high data charges by lowering your data usage every month. Don’t be afraid to shop around for better deals.

Is there a way you can cut down on food costs? Focus on staple foods that last a long time such as rice, potatoes, beans, etc. Pay attention to eating out and limit it to only special occasions.

Adopting a more frugal lifestyle will vary for everyone but it’s important that you are always looking for ways to reduce your expenses, even if its small amounts.

There is one thing I won’t recommend that a lot of finance experts do, and that’s to move. Trust me, I know what it’s like to barely make ends meet. I lived it for almost 4 years. When I started my pay off journey, nothing frustrated me more than reading that I should move to save money. Yes, moving has the potential to save you some big bucks, but it’s also not a realistic option for a lot of people and can be expensive. If you have been behind on bills for a while, then your credit score and payment history might not get you into a cheaper place than you have now. Before you contemplate moving to save money, look for ways to cut down on your current lifestyle first. Once you have squeezed every dollar you could from finding ways to save, then look into relocating.

The next step in the process is making extra income. During this point, a lot of people will just say, “Get another job.” It’s true that getting a second job would provide much-needed income but it can really hinder family dynamics. Earning extra money is important, but overworking yourself isn’t a good idea. Spending time with your family and having a life to do things you enjoy is crucial when you have hit rock bottom. It’s important to keep your spirits up and to maintain a healthy mindset along the way.

Now is the time to keep your eyes open for opportunities to make some extra cash. There are a ton of ways to earn extra money without having to get a second job. It’s all about learning to be resourceful even though at first you might feel like you are giving up a lot. Here are some ways you can earn extra income:

- Sell your stuff: I have a surprise challenge for you. Right now, I want you to get up and find two things in your home you are no longer using. Research what these items are selling for used. One way to do this is by simply searching Craigslist. Your challenge tonight is to find two things you can list for sale on the internet. Do your research, take pictures of your used items, and place them for sale. If you don’t feel comfortable with using Craigslist, Lifehacker wrote an amazing article with some tips on selling your stuff on Amazon.

- Look for better opportunities at your current job. I know the thought of asking for a raise can seem scary but you will never know unless you ask.

- Turn a hobby into cash. Do you have a special talent? Can you turn your art into a paycheck or your knitting into a side business?

It’s time to look at every angle and seize the opportunities that are in front of you.

It’s important to update your budget regularly. When you are tight on cash or funds it might be easy to overspend. You also need to make sure that you add the debt-repayment plans that you negotiated with your creditors from Step #2 to your overall budget. For example, if your mortgage payment is $500/mo and you ended up negotiating with your lender that you would make an extra payment of $100 until you are caught up, then you need to add that extra $100 to your monthly budget to reflect your new monthly payment of $600 ($500 minimum payment +$100 extra payment).

When you are completing and updating your budget always make sure the numbers you write down are realistic. Nothing will set you up for failure more than having an unrealistic budget. If you know there is no possible way you can spend less than $200/mo on food for your family, then keep your food budget at $200. It might make you feel better to write down and see $150 on your budget, but it’s not realistic and you will end up failing.

If you are behind on bills and are wanting to get back on the right track, budgeting is your answer. By creating and sticking to a budget and creating a plan of attack to take care of past due bills, you will feel more and more like you are in control and that’s exactly where you want to be!

Did you complete the challenge from this article? How much did you make by selling two unused items from your home?

Original article and pictures take www.thebudgetmom.com site

Комментариев нет:

Отправить комментарий